ELITE ROBOTS: The European Cobot Market at the End of the Pandemic

I was commissioned by ELITE ROBOT, the up-and-coming Chinese cobot start-up, to represent the European market. I also received permission to publish excerpts here. The company is aiming at the local market and is looking for distributors, sales professionals and technicians. If you are interested, please contact the partners already in Portugal and Italy.

The pandemic seems to be nearing its end in Europe - sooner or later, depending on the risk assessment. Time to look back and consider what impact the pandemic has had on robotics.

Economic development

In the first year of the pandemic, i.e. 2020, there was a sharp drop in economic output in all European countries. The main reason for this was the shock, including factory closures as a protective measure and lockdowns. In 2021, the economy recovered, although the previous level has not yet been reached again. This was due to further closures as well as shortages of materials. The economy has recovered in the meantime, but is still below the level before the pandemic began. This may be due - especially in Germany - to the previously unknown supply bottlenecks. In 2021, various car manufacturers had to close their plants for weeks. The German car manufacturer VW produced as few cars at its main plant in Wolfsburg as it had last done over 60 years ago. In the meantime, numerous sectors have been affected by supply bottlenecks. However, the mood in most sectors of the manufacturing industry is positive.

Some of the main industries relevant to robotics are very optimistic. The mechanical engineering sector expects another peak year and should have generated more revenue by the end of 2022 than before Corona. In addition, there is the transformation of the vehicle industry with correspondingly many investments in new production facilities for electromobility including battery production. On the other hand, there is hardly any investment in the production of combustion engines. Nevertheless, there is potential for cobots in the automotive industry. An example of this is the use case Fiat 500, whose assembly is supported by 11 cobots. This is also because the average age of Fiat workers is steadily increasing, making ergonomics more important (link). This is likely to apply to almost all car factories in Europe except one.

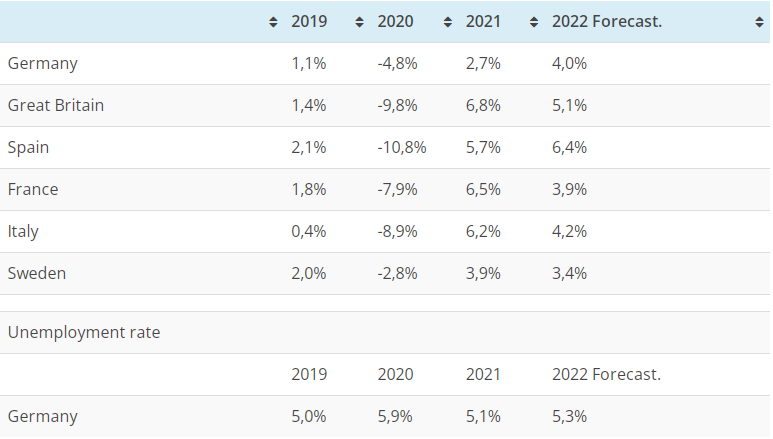

The development of the gross domestic product of important countries can be taken from this table:

The table shows that countries with a particularly strong slump in 2020 grew more strongly in 2021 than those with a more moderate slump. Optimism for 2022 appears to be more important: a positive growth expectation is significant for two reasons: on the one hand, rising revenues make it easier to implement price increases, so that profits then also rise, and even more so, a positive assessment can be cited as the most important prerequisite for investment. The German state bank KfW published a survey on investment behaviour in SMEs in October 2021. 62% of companies expand their investments when the sales expectations for their own company are positive. Conversely, 43% of companies reduce their investments when revenues are falling.

China - ELITE ROBOT

After his re-election, our Federal President Steinmeier said that the West had weathered the pandemic best. Well, he probably wasn't thinking of China. The country had significantly fewer fatalities than Germany or the USA. While Europe was paralysed for a while, normality largely prevailed in China. The cobot manufacturer ELITE ROBOT, partner of the article, even built a new large production facility, intensified its development and closed another round of financing. Since the company hardly uses any bought-in parts, the video shows more employees on the shop floor than in other companies.

Has consumer behaviour changed as a result of the pandemic?

Since the beginning of the pandemic, there have been "winner" and "loser" industries. The "winners" in 2020 included all industries that promote the protection and/or entertainment of the individual. These include leisure sectors such as two-wheelers (bicycles, also with electricity as well as motorbikes), mobile homes or consumer electronics. Construction suppliers were also among the winners. During the lockdown, do-it-yourselfers became active. On the other hand, gastronomy and culture, which suffered and still suffer from the often strict state regulations, lost out. Sometimes they were closed down completely, then they were only allowed to serve vaccinated people. The gastronomy sector was and is financially compensated, but is likely to suffer permanently from an exodus of its staff. The pandemic has shown that companies hardly change their procedures even in the face of great staff shortages and extreme capacity shortages: The Corona test labs in particular had a lot to do, but did not automate.

How has the European cobot market developed?

Significantly for robotics, almost all trade fairs were cancelled and often the dates of visits. Many entrepreneurs see a cobot for the first time at a trade fair. This opportunity for often random viewing was eliminated. Companies rarely buy cobots online or on the phone. They first want to get to know their contacts and learn more about robotics. They also want to be sure that there is a customised solution that is exactly right for them. This was difficult to achieve at times in 2020/ 21. It was also hardly possible to hold regional network meetings where entrepreneurs could exchange information with each other. After the first wave, which lasted until the end of May, the second wave began in October 2020. This was associated with a ban on visits to companies and ultimately a lack of willingness to make new contacts. Until today, trade fairs practically no longer took place, at best virtually. However, the benefit of the virtual fairs was very limited.

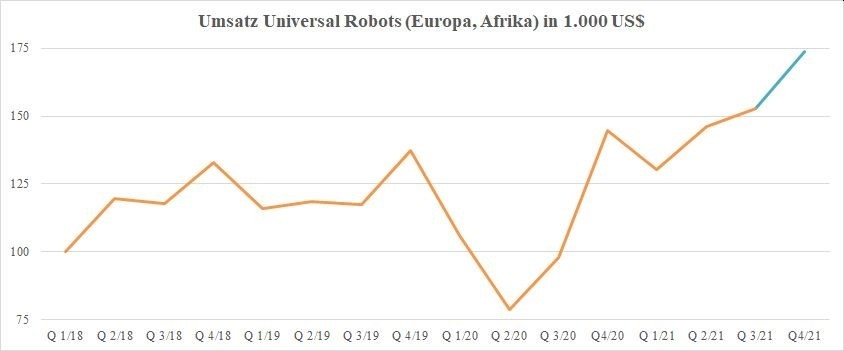

Especially at the beginning of the pandemic, robotics sales plummeted. From the 3rd quarter of 2020, the development improved significantly and since then new sales records have been achieved. The market leader's figures provide the necessary transparency here (blue line = estimate). Since its market share in Europe is unlikely to have changed much, its development is exemplary for the cobot industry:

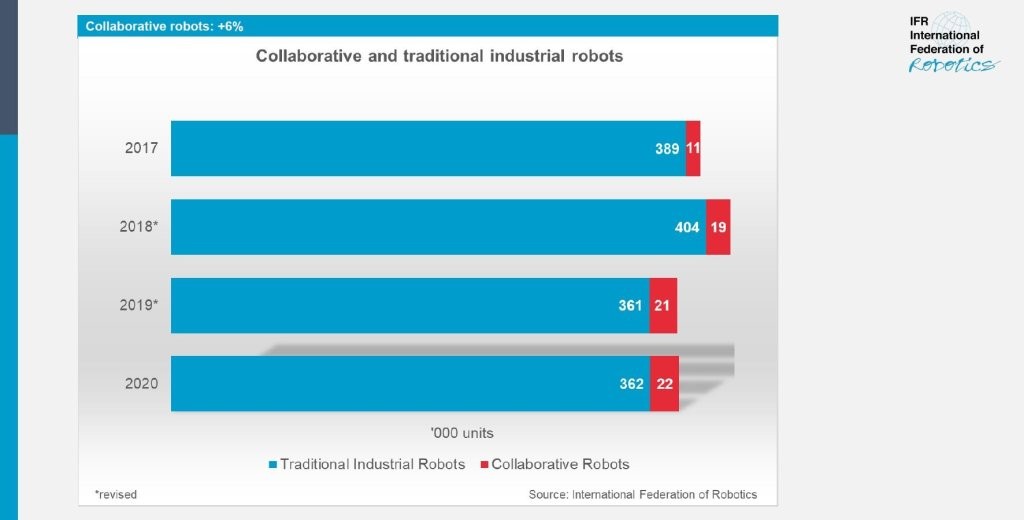

In relative terms, the importance of cobots stagnated worldwide in 2020, as this graph illustrates:

In 2021, the development is likely to have been significantly more positive.

Development in Great Britain

At the beginning of the pandemic, Universal Robots' then new Scottish distributor, SP Automation & Robotics, announced that it would sell £1 million worth of cobots in the first year of the collaboration. For a country with a population of only 5.5 million, this is a considerable sum. As the company has been busy uploading cobot videos for the last two years, it should have been quite successful. This shows that an established company can launch a new product even under more difficult circumstances.

WMH Transmissions, the Universal Robots dealer with the largest showroom in the UK, makes less than €6 million. Preliminary balance sheet figures show a recent stagnant performance.

Overall, then, the development in the UK seems to have been stable. In contrast to Germany, however, there seems to be less competition in the UK. Companies founded in Germany such as Franka Emika, Yuanda, Neura Robotics, Agile Robots or RobCo are virtually unknown. And start-ups like Kassow Robots still seem to have a weak base in the UK.

Portugal: A country with considerable ELITE ROBOT market share

Portugal seems to be a special country for the robotics and cobot industry. On the one hand, there are only 10 million people living in the country and then also with their own language. On the other hand, there are many interesting manufacturing companies in Portugal, especially in electronics and precision mechanics.

In addition, the Chinese cobot manufacturer ELITE ROBOTS has a very active partner in Portugal. This has already been reported on here.

Italy: AutomationWare has invested heavily in its Cobot business

Automation specialist AutomationWare (Venice) has not gone into shock during the pandemic, but has invested in new partnerships. First it became a partner of ELITE ROBOTS, the partner of this article, and more recently of Geek+. In the video, Automationware presents the Cobot as its own development, but I assume that it is an ELITE ROBOTS.

Globalised robotics companies fared better

In Germany, there are many accessory companies in addition to some robot manufacturers. Schunk, Zimmer, Sensopart and many others are now compatible with various Chinese brands. Since ELITE ROBOT is configured like Universal Robots out of the box, some manufacturers have been able to benefit from the more stable Chinese market without switching.

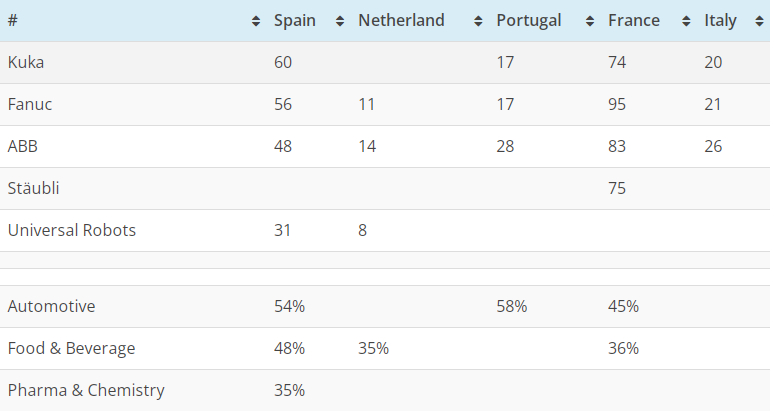

Which robot manufacturers are preferred?

Presumably because the demand for cobots in the individual countries is still too low, there is no detailed breakdown by cobot manufacturer and country. However, it seems remarkable that the market leader in cobots, Universal Robots, is mentioned more often.

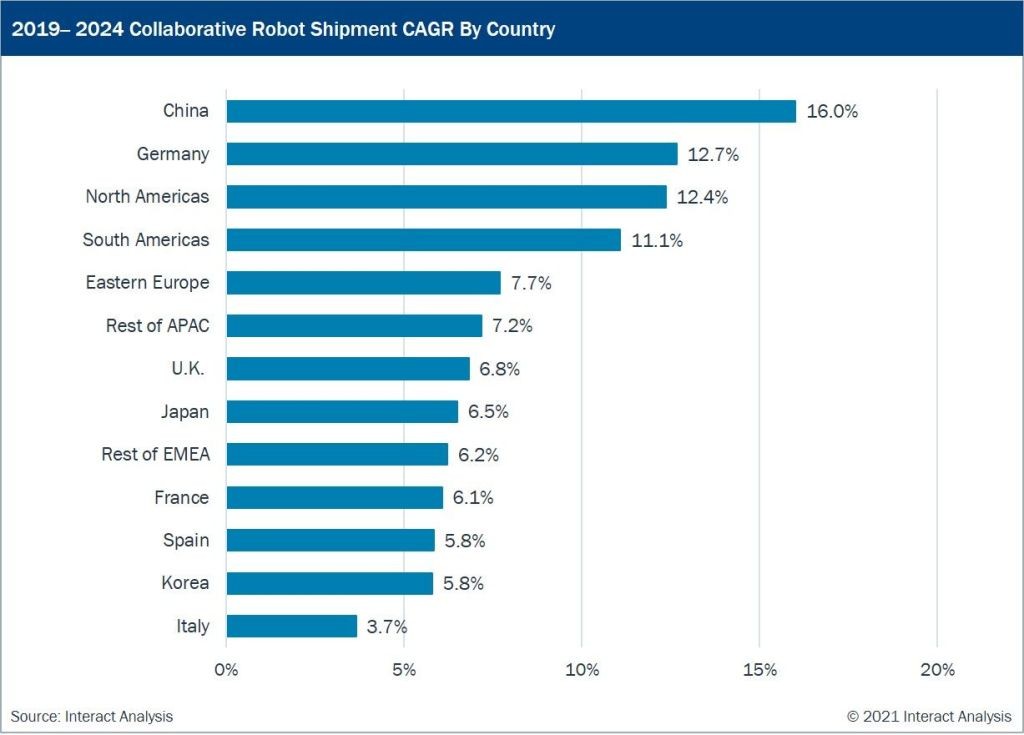

High demand can be met

Now the sales are being achieved that were actually already expected for 2019. More astonishing than the sales development itself appears to be the extensive ability to deliver in times of chip shortage. From today's perspective, Germany and Eastern Europe have above-average growth potential in Europe. It should be noted that it is not only the expected growth that counts, but also the starting point. This is likely to have been quite low everywhere. In absolute terms, the potential in Eastern Europe - and especially in Poland - is probably greater than in Italy. In Italy, on the other hand, the bulk of the cobots seem to be sellable in the north of the country. It also seems important to note that the data shown below was collected before the take-off of electromobility and the construction of new chip factories in Europe. In Germany, in particular, a lot is currently being invested in battery production and further chip plants. This means that growth here can be even higher.

The further prospects for Cobot sales are very good. When differentiating by country, the typical industrial structure in the countries is also likely to be important. Are there more large or small series.

Complete solutions are gaining in importance

ew Cobot customers in particular welcome complete offers. Ideally, one contact person sells them a complete workstation. This ensures cost transparency, one contact person, lower risk and simpler processes in themselves. Complete welding cells, palletising stations and placement robots are particularly worth mentioning. For the supplier this offers the possibility of scaling, he only has to coordinate a system once. Any fine-tuning at the customer's site costs far less time. For the cobot manufacturer, this also offers the possibility of scaling, of reducing the workload, but also the risk of interchangeability. Brand-strong cell suppliers do not even name the cobot manufacturer. I.e. they could replace it at any time.

Perhaps the world's largest tool dealer, the Hoffmann Group, offers machine tending based on an industrial robot (Nachi), but this also has a payload of only 12 kg. The reason for this is probably that due to the handling of heavy parts etc., strict regulations apply anyway. At present, the solution, which is said to be available for as little as €60,000 including area scanner and CE certification, is only offered in German-speaking countries.

It is also interesting that new providers who do not yet have a name themselves do not put the Cobot in the foreground. Cooking box manufacturers such as Aitme or Davinci Kitchen advertise their technology, but not the cobot they use. Why should they? The potential customer will be unfamiliar with the cobot manufacturer.

Only in the case of palletising robots does the cobot manufacturer appear to be a purchasing criterion. This means that the supplier usually mentions the name of the robotics partner. This may result from the fact that the suppliers also come from the automation industry and are therefore just as familiar to potential customers as Demmeler, Lorch, Fronius, Heidenbluth etc. in the welding sector.

New providers

During the pandemic, online platforms increasingly appeared. However, their emergence was probably independent of the pandemic. It was simply time. After all, cobots or robots are still not bought at the click of a mouse. For initial contact, however, a good online presence, including price information, offers the opportunity to reduce the inhibition threshold to contact. There are about a handful of manufacturer-independent online providers. The business models differ:

- https://unchainedrobotics.de/: Largest marketplace for cobots (not industrial robots), also available in English. In Germany, they are also installed on site.

- https://www.go2automation.de/ Brings together integrators, manufacturers and users (mediation)

- https://coboworx.com/: The well-funded start-up around the ex-Fanuc Europe boss Gehrels began as an online integrator and now develops its own low-cost industrial robots that are installed in its own stations. A palletising solution up to 30 kg is available from 2,800 €/month. Further complete solutions are in the pipeline.

Individual robot manufacturers offer online services themselves. ABB and igus are worth mentioning, and Doosan has an integrator online.